The stolen Bitcoins were valued at nearly half a million dollars when the theft was discovered.

Interestingly, the information in this file isn’t encrypted by default, meaning you’re at risk of losing your crypto holdings if someone gains access to your computer.) (As you probably know, the wallet.dat file contains sensitive wallet information that allows you to access your crypto. With the file, the hackers had all they needed to steal as much Bitcoin as they wanted undetected. They were aware of the security risks of storing users’ cryptocurrencies in a hot wallet, yet they did the same.īlockonomi, in an article, explained that the private key could have been stolen as far back as the June 2011 attack when the hackers accessed the exchange’s wallet.dat file. To answer the earlier question, the hacks have been put down by many people to poor management and pure negligence on the exchange’s part. The news sent Bitcoin’s price crashing by 20%. Gox, hackers stole 744,408 BTC from customer wallets and 100,000 BTC along with $27 million cash from Mt. The final blow came in February 2014, when the exchange suspended Bitcoin withdrawals and announced they’d lost over 850,000 BTC (around 6% of Bitcoin’s circulating supply at the time). Gox on the Bitcoin market at the time, the second hack crashed the price of Bitcoin from $17 to one cent. Some months later, another attack took place, which saw about 2,600 BTC moved using McCaleb’s auditor account. The former owner retained admin rights to audit transactions and was entitled to Mt. McCaleb later sold the exchange to Mark Karpelès, who became the CEO and largest shareholder. The first attack happened in 2011 when hackers used stolen wallet credentials to transfer about 80,000 BTC to another wallet. Gox a prime target for hackers, as it suffered several security breaches throughout its period of operation. The exchange operated between 20 and controlled over 70% of all Bitcoin trades at its peak. However, McCaleb eventually abandoned the project and repurposed the domain to develop the world’s biggest Bitcoin exchange. McCaleb had initially created the website in 2006 for players of the online version of strategy card game Magic: The Gathering Online to trade cards. Gox is an acronym for “Magic: The Gathering - Online eXchange”. It was founded by programmer Jed McCaleb in 2010.įun fact: Mt. Gox (sometimes MtGox or Mt Gox) was a Bitcoin exchange based in Tokyo, Japan. Now, you might wonder how exactly it happened? We’ll get to that, but first, some context… Background

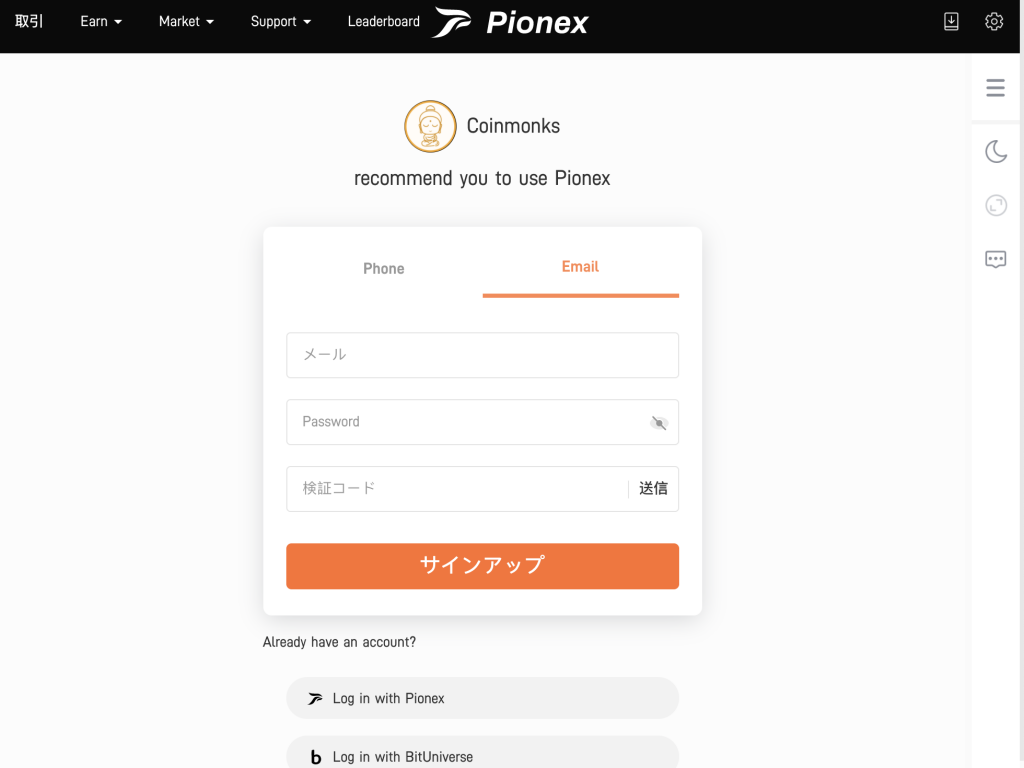

COINCHECK BOT SERIES

Now-defunct crypto exchange Mt.Gox was hit by a series of thefts spanning several years (2011 to 2014), in what can be safely termed the most “talked-about” exchange heist in the crypto space. That said, here are the three most high-profile hacks and cryptocurrency exchange thefts, in no particular order. On the contrary, it goes further to closely examine which of the events left a lasting mark on the crypto space to date. Side note: This article doesn’t simply rank the hacks based on how much the criminals made off with in total. We’ll examine in detail how each heist happened, what action(s) the affected parties took, and the aftermath of the heist. In this article, we’ll take a closer look at some of the most high-profile hacks and exchange thefts in the history of cryptocurrency. For instance, blockchain analytics company CipherTrace earlier reported criminals stole a whopping $1.36 billion in cryptocurrency from January to May 2020 alone. Hackers, scammers, … and just about every bad guy in crypto have all become savvier and annoyingly persistent in their dealings. Perhaps notably, however, we’ve seen firsthand how the criminal underbelly of the crypto space has advanced faster than expected. More accurately, it was a year filled with memorable - and equally, infamous - events like the DeFi ‘boom’, Bitcoin’s record-smashing bull run, several flash loan attacks on DeFi protocols, PayPal’s dalliance with crypto, and many more. It’s safe to say the coronavirus outbreak was the major highlight of the year, with millions of lives and livelihoods affected globally.Īlthough the year itself threw the larger human collective in the throes of a global health crisis and a resulting economic crisis, it was an excellent year for the crypto space. 2020 is finally drawing to a close, and the whole of humanity is now drawing the curtains on what has been an eventful year.

0 kommentar(er)

0 kommentar(er)